Egyptian Economy Is Emerging as the Key Winner of the Post-Gaza War Regional Order

Egypt enters 2026 with improving macro indicators, rising private investment, and renewed Suez Canal momentum, driven by the stabilising effects of the post-Gaza war regional order.

The 27 November releases from the Ministry of Planning, Economic Development and International Cooperation provide a rare moment of clarity. After two turbulent years, Egypt’s macro indicators are beginning to strengthen. The ministry reports stronger private investment in the first quarter of fiscal year 2025 to 2026, a recovery in GDP growth to roughly 5.3% and a set of structural reforms rolled out since July 2024 that aim to stabilise the investment climate. These announcements are not routine bureaucratic updates. They capture a political economy that is repositioning itself in response to regional shifts triggered by the end of the Gaza war.

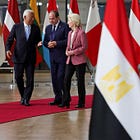

Egypt’s economic uptick cannot be divorced from the geopolitical environment. The country has been a central broker in the ceasefire, the border arrangements and the security architecture that followed. That role has translated into renewed diplomatic capital and a flow of external commitments that would not have materialised in the absence of the war’s end. Egypt is effectively a key beneficiary of the post-Gaza regional order, and this is now visible in the numbers.

Private investment is recovering because regional risk has eased

The ministry’s headline is clear. Private sector investment continued to rise in the first quarter of 2025 to 2026. This is not the usual rhetoric about reviving the private economy. It reflects a real shift in investor sentiment. Two factors explain this movement. First, the risk premium that defined Egypt during the war period has fallen as regional escalation fears receded. Second, cross-border capital has begun to return to Egypt.

Egypt has been central to the ceasefire, the Rafah arrangements and the post-conflict diplomatic framework. That has raised confidence in the country’s stability profile. Gulf investors are also revisiting projects shelved in 2023 and 2024. The ministry’s language highlights new commitments and sustained interest, not only tax or regulatory incentives. Investment is rising because Egyptian stability now carries direct geopolitical value and ensures peace and stability.

GDP growth is a political signal as much as an economic result

The ministry stresses that GDP growth in the first quarter reached about 5.3%. This is the highest rate in more than three years. The number has two layers. Economically, it reflects improved activity in logistics, services and communications. Politically, it signals that Egypt is regaining the confidence of external partners. Major international institutions have already revised forecasts upward on expectations that regional trade routes, energy flows and transport corridors will normalise after the Gaza war settlement.

The Suez Canal is a central component of this. Traffic has gradually increased as maritime risk declined. The war created uncertainty across the Red Sea and Eastern Mediterranean routes. Its resolution is allowing shipping flows to rebound. The canal’s recovery feeds directly into Egypt’s external position and supports the macro numbers the ministry highlighted on 27 November.

The ministry’s emphasised structural reforms implemented since July 2024. These include changes in licensing, digitalisation of public services and a greater focus on private sector access. The timing is deliberate. The government positioned these reforms to coincide with the expected regional settlement. As the Gaza ceasefire process gained traction, Cairo accelerated domestic reforms to ensure it could receive the economic benefits.

The regional order after Gaza is creating space for Egyptian growth

Egypt’s resurgence cannot be analysed in isolation from Gaza. The country’s central diplomatic role has made it a principal beneficiary of the new regional arrangements. The Gulf states have an interest in stabilising Egypt. The United States and Europe rely on Cairo as a guarantor of border security and humanitarian management. Israel needs a predictable partner on the Rafah corridor. China and other Asian partners require stable Red Sea and Suez routes for global supply chains.

If current regional stability holds, Egypt’s macro numbers are likely to strengthen further in 2026. Suez Canal receipts will rise. Foreign capital flows will stabilise. Tourism will continue to recover. The country’s position as a central broker in the post-Gaza architecture gives it leverage it has not enjoyed for a decade. Egypt’s political economy is moving out of crisis and into a phase shaped by a new regional equilibrium, turning regional stability into economic momentum.

Follow us:

📱 Twitter (X): @MENAUnleashed

🎥 YouTube: MENA Unleashed

📸 Instagram: @MENAUnleashed

💼 LinkedIn: MENA Unleashed

🎵 TikTok: @MENAUnleashed