In Defiance of Hamas, the UAE Completes the First Pillar of the IMEC

Israel upgraded its war objectives, but Hamas and its allies have failed to adapt, raising questions about the effectiveness of their current military efforts against Israel.

Introduction

Jordan and the UAE have just signed a Comprehensive Economic Partnership Agreement (CEPA), marking the first such agreement between the UAE and an Arab nation. This milestone forms part of the UAE’s broader strategy to expand its free trade agreements globally, following its first CEPA with India in 2021. Alongside this, the two parties signed an Administrative Cooperation Agreement on Customs Matters, aimed at improving customs collaboration and facilitating smoother trade between them.

The agreements are designed to strengthen trade and investment ties, spur growth in key industries, and reinforce supply chains. The CEPA is expected to remove trade barriers, reduce non-tariff measures, and promote collaboration in sectors such as renewable energy, manufacturing, transport, pharmaceuticals, and food processing. Jordan is the UAE’s third-largest Arab trade partner outside the GCC, and the UAE remains Jordan's leading foreign investor, with investments totalling approximately $22.5 billion.

Completion of the First Pillar of the IMEC

Beyond enhancing bilateral ties, the agreement represents the completion of the first pillar of the India-Middle East-Europe Economic Corridor (IMEC) and the Abraham market. The UAE now holds free trade agreements connecting India with the Gulf, Jordan, Israel, and Europe, as originally envisioned under the IMEC. For the first time in the region’s history, supply chains from India to Europe, through the Middle East, will face minimal tariffs and disruptions.

When the Gaza war began, Hamas aimed to disrupt the IMEC. Attacks on Jordan’s land bridge between Israel and the Gulf, protests in Jordan against the land bridge, and rocket attacks on Israeli ports raised concerns about the feasibility of the IMEC. While these physical challenges remain, the regulatory framework for the corridor is now complete. The land bridge, energy pipelines, and data cables associated with the IMEC now have the necessary legal frameworks in place, making the region more attractive for new investments. The UAE has already launched a series of investments in data centres, aiming to position itself as a data hub for the region, connecting Asia with Europe.

Security Agreements and US Partnerships

In terms of security, the UAE became a close partner of the US last month, following in the footsteps of Qatar and Bahrain. Saudi Arabia is awaiting its own agreement, pending normalisation with Israel. This agreement could be signed as early as 2025, completing the IMEC security framework under US leadership. While Israel and the US handle the military and security aspects of market creation, the UAE is focused on the regulatory and financial components. It is completing relevant free trade agreements and investing in future technologies such as renewable energy, AI, and big data.

Reframing the Gaza War and the Abraham Market

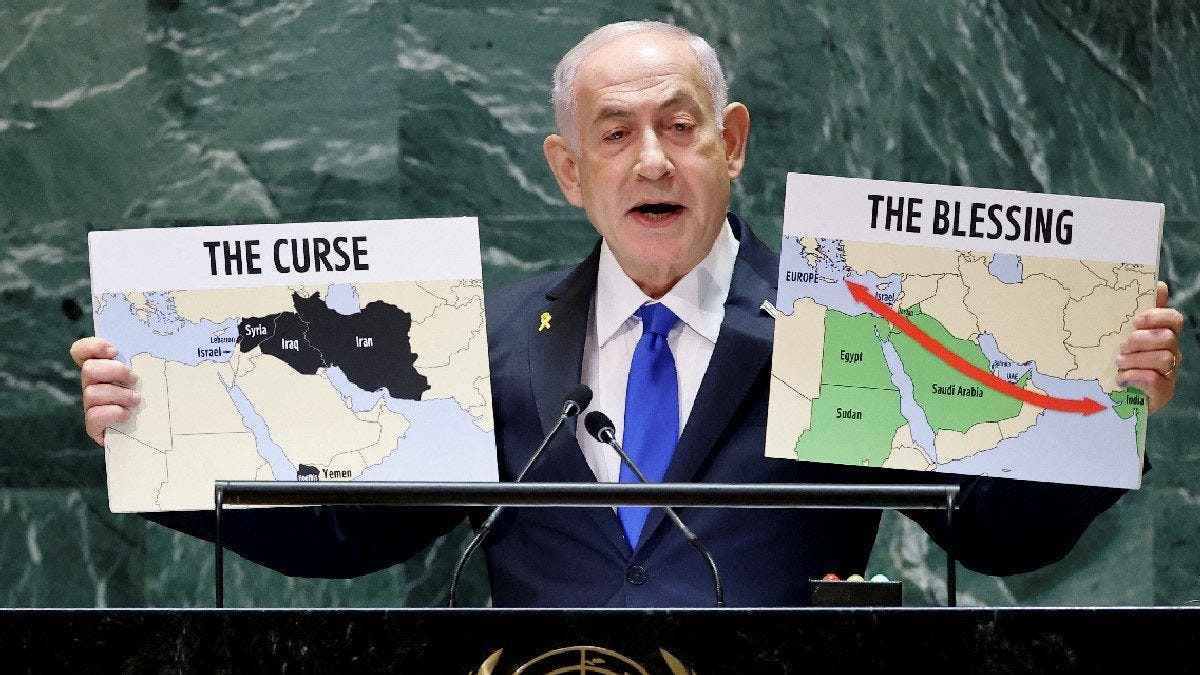

During recent visits to Washington DC and New York, Israeli Prime Minister Benjamin Netanyahu reframed the Gaza war, moving from a focus on eliminating Hamas to a broader goal of establishing the Abraham market and the IMEC under the US security umbrella. Hamas and its allies have tried to divert Israel’s attention to the Gaza conflict, hoping to prevent the creation of the regional market. Although this tactic worked for the first six months of the war, Israel is now regaining the initiative, pushing forward with an expansive regional military campaign to protect the market and eliminate threats.

The Changing Dynamics of the Conflict

As Israel upgrades its war objectives, it appears that Hamas and its allies have failed to adapt, raising questions about the effectiveness of their current military efforts against Israel and its regional partners. The UAE has hedged its bets, signing into Iraq’s Development Road Initiative and establishing a free trade agreement with Turkey in 2023. Meanwhile, Saudi Arabia has launched an international alliance to advocate for a two-state solution, likely as a means to justify its forthcoming normalisation with Israel. While Israel may not be able to militarily defeat Hamas and its allies outright, it is creating new realities with the Abraham market, which will be viewed as a strategic victory after months of tactical gains and strategic uncertainty.