Qatar to Finalise India FTA Amid Rising Gulf Tensions

Doha is pushing ahead of its Gulf neighbours.

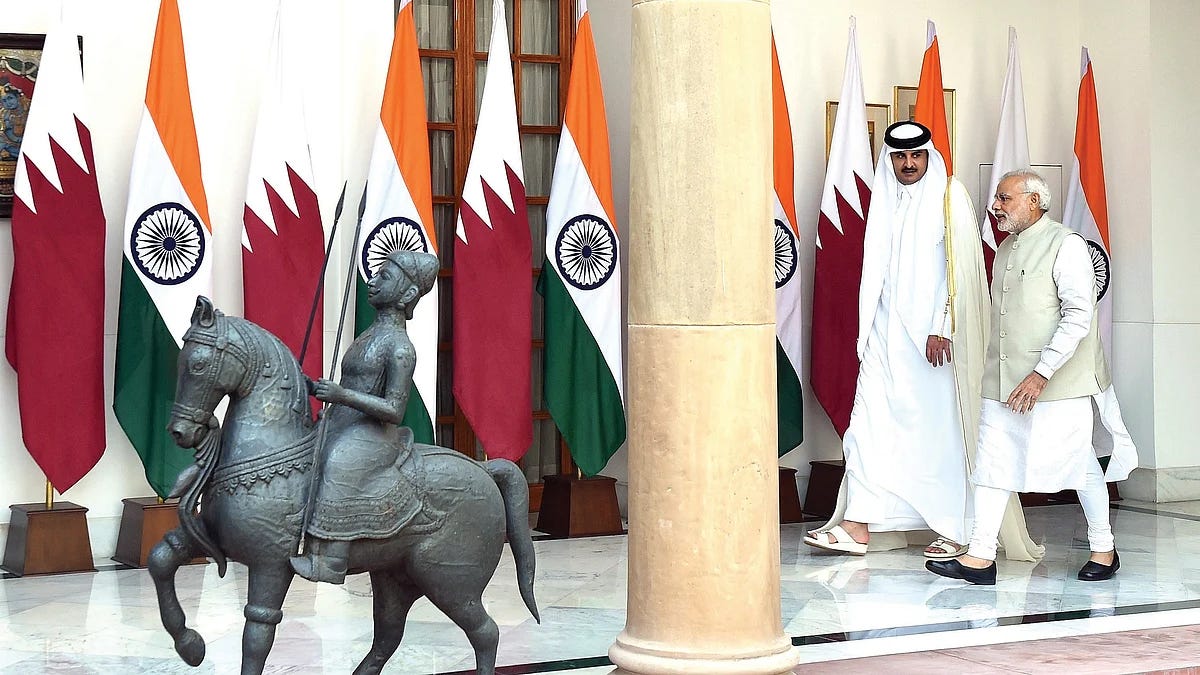

Qatar is set to finalise what would be the second-ever comprehensive free trade agreement (FTA) between a Gulf state and India, with terms expected to be agreed by early October. Doha has been in discussions with New Delhi for nearly a decade, though progress has often been stalled by disputes over tariffs, market access and rules of origin. For any Gulf country, an FTA with India represents a major strategic gain, given the South Asian nation’s role as both a key trading partner and the principal source of migrant labour in the region. The breakthrough would highlight Qatar’s ability to move ahead of many of its Gulf Cooperation Council (GCC) peers. While other member states—and the bloc collectively—have long pursued trade negotiations with India, only the United Arab Emirates has previously concluded a full agreement. By advancing ahead of its neighbours, Qatar has positioned itself at the forefront of Gulf–India relations, building on enhanced engagement with New Delhi earlier this year.

The GCC’s MVP

The Gulf Cooperation Council is India’s largest trading partner grouping. Bilateral trade reached $165 billion in FY 2023–24, rising from $142 billion the year before, with projections for FY 2024–25 at around $180 billion. The Gulf accounts for over 15% of India’s global trade, with energy exports generating a GCC surplus of $61 billion. India supplies nearly one-fifth of the bloc’s food and pharmaceutical imports, though hydrocarbons remain dominant.

The migrant workforce, particularly concentrated in Qatar and the UAE, remains a critical element of this relationship. More than nine million Indians live and work across the GCC; in Qatar alone, Indian expatriates outnumber citizens by roughly two to one, underpinning key sectors such as construction, hospitality and infrastructure.

The reelection of US President Donald Trump and the imposition of tariffs of up to 50% on Indian exports have prompted India to recalibrate its foreign policy strategy. New Delhi has sought to pivot eastwards, visiting China despite strained ties, and to accelerate negotiations on both the Qatari FTA and a prospective FTA with the European Union.

Energy at the Core

Energy constitutes approximately 60% of India–GCC trade, with the Gulf providing 70% of India’s LNG imports and around 35% of crude oil needs. Qatar is India’s foremost LNG supplier, meeting nearly half of its requirements through long-term contracts. While non-energy trade, including textiles, gems and chemicals, is currently modest, the FTA is expected to reduce tariffs on up to 90% of goods and ease professional mobility in Qatar’s expanding services economy. Bilateral trade could rise from $14 billion in 2024 to $28 billion by 2030, supported by joint ventures in areas such as food security and renewable energy.

The Strait of Hormuz Factor

Yet this progress unfolds against a backdrop of rising geopolitical risk. The Strait of Hormuz, a 21-mile maritime corridor between Iran and Oman, handles nearly one-fifth of global oil flows and remains central to India’s energy imports. Tensions have escalated following U.S. strikes on Iranian nuclear facilities in June and subsequent rhetoric in Tehran about a potential closure of the strait. While Qatar’s LNG exports to India can bypass the chokepoint via alternative routes, any disruption would almost certainly drive oil prices higher, raising India’s import costs and domestic fuel prices.

India is somewhat insulated by diversified supplies, including crude from Russia and LNG from the United States and Australia. Nevertheless, preferential access to Qatari gas under the new FTA would help mitigate volatility. For Qatar, meanwhile, the agreement offers both a hedge against energy transition pressures and a means of reinforcing its global partnerships at a time of heightened regional tension.