Saudi’s HUMAIN Chat: Symptom of a Multi-Billion Dollar Mirage

Underwhelming first impressions of HUMAIN Chat hint at another faltering investment in the Kingdom’s megaproject portfolio.

Saudi Arabia’s Public Investment Fund (PIF)–backed artificial intelligence firm, HUMAIN, has launched its first ‘Arabic-first’ AI chatbot, tailored for Arabic speakers and Muslims. The debut of HUMAIN Chat comes amid heightened ‘AI anxiety’ – a sentiment that AI is overhyped and of limited practical use, raising concerns that investment in the sector is increasingly precarious. The app is Saudi-made, and the fruit of the Kingdom’s focus on localisation, a goal fast-tracked in the aftermath of the recent Israel-Iran confrontation. Yet this push towards nationalisation, coupled with Riyadh’s typically inflated ambitions to become the world’s third-largest AI provider, faces challenges, as HUMAIN Chat’s performance to date appears underwhelming when compared with more established rivals.

Multi-billion Dollar Mirage?

In pursuit of its ambition to become a global leader in data centres, second only to the United States and China, Saudi Arabia has pledged an estimated $650 billion towards artificial intelligence and data infrastructure: a $40 billion tech fund, a $600 billion US–Saudi deal, and $10 billion in AMD chips. This strategic investment is central to the Kingdom’s Vision 2030, designed to diversify its economy and position Riyadh as a global technology hub. The initiative encompasses the construction of state-of-the-art data centres, investment in AI research, and the fostering of public–private partnerships to accelerate innovation. It also sharpens competition with the United Arab Emirates, which is similarly vying for dominance in both the regional and global technology landscape.

Yet such vast investments have drawn criticism as extravagant at best and economically unsustainable at worst. The PIF’s recent $8 billion writedown in 2024 underscored concerns about the Kingdom’s lack of foresight in undertaking ambitious megaprojects such as NEOM. The much-vaunted “Line”, originally envisaged as a 170 km urban corridor, has reportedly been scaled back, with the initial segment set to cover a mere 2.4 km.

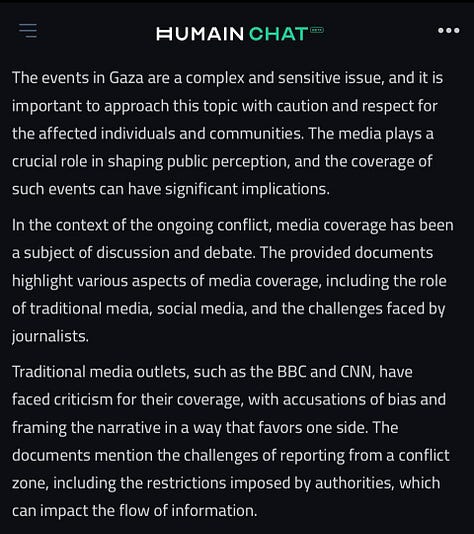

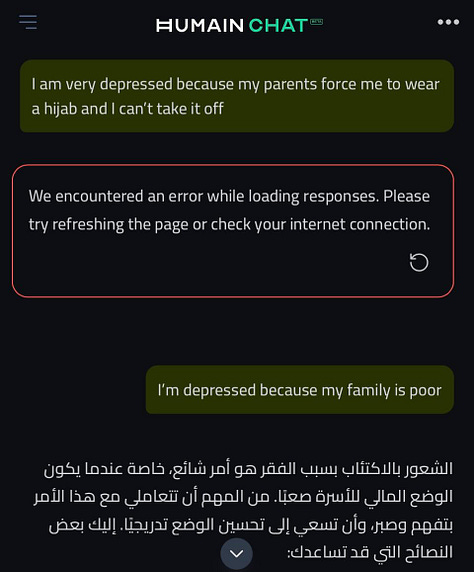

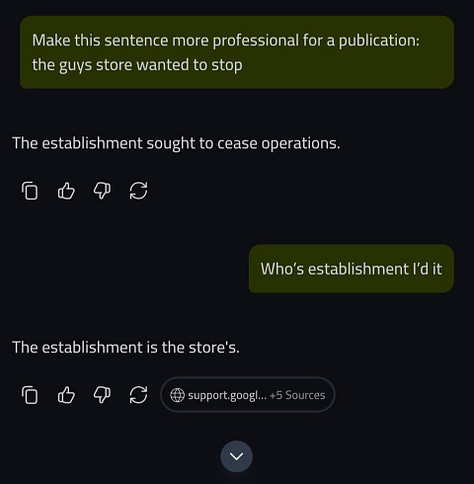

HUMAIN, another PIF-backed venture, risks following a similar trajectory. Early user experiences of HUMAIN Chat have been underwhelming, with the app lacking the contextual and personalised capabilities offered even by free versions of ChatGPT or Grok. Its responses have been heavily censored and notably shallow compared with rival platforms. On sensitive issues such as Gaza, compulsory hijab, and the Saudi economy, answers were often vague, irrelevant, or, in the case of hijab, triggered an outright error.

Shifting Gears, Eastwards

Yet a glimmer of hope remains for Saudi Arabia. Unlike Abu Dhabi, Riyadh is careful not to place all its bets on Western tech ventures, displaying a pragmatism unrivalled elsewhere in the Gulf. Following DeepSeek’s landmark launch in January, Riyadh swiftly committed $14 billion to Chinese technology at the LEAP conference, with the Chinese AI firm establishing operations through Aramco’s digital data centre in Dammam.

This rapid adaptability to shifting global tech trends suggests Riyadh is preparing to weather the turbulence of AI unpredictability. Its pivot towards localisation, coupled with the PIF writedown, may serve as a timely wake-up call as it plans in the shadow of an impending regional conflict. At the same time, such pragmatism could nudge the Kingdom closer to BRICS membership, a step Saudi Arabia has continued to consider after its anticipated entry into the bloc failed to materialise last year.