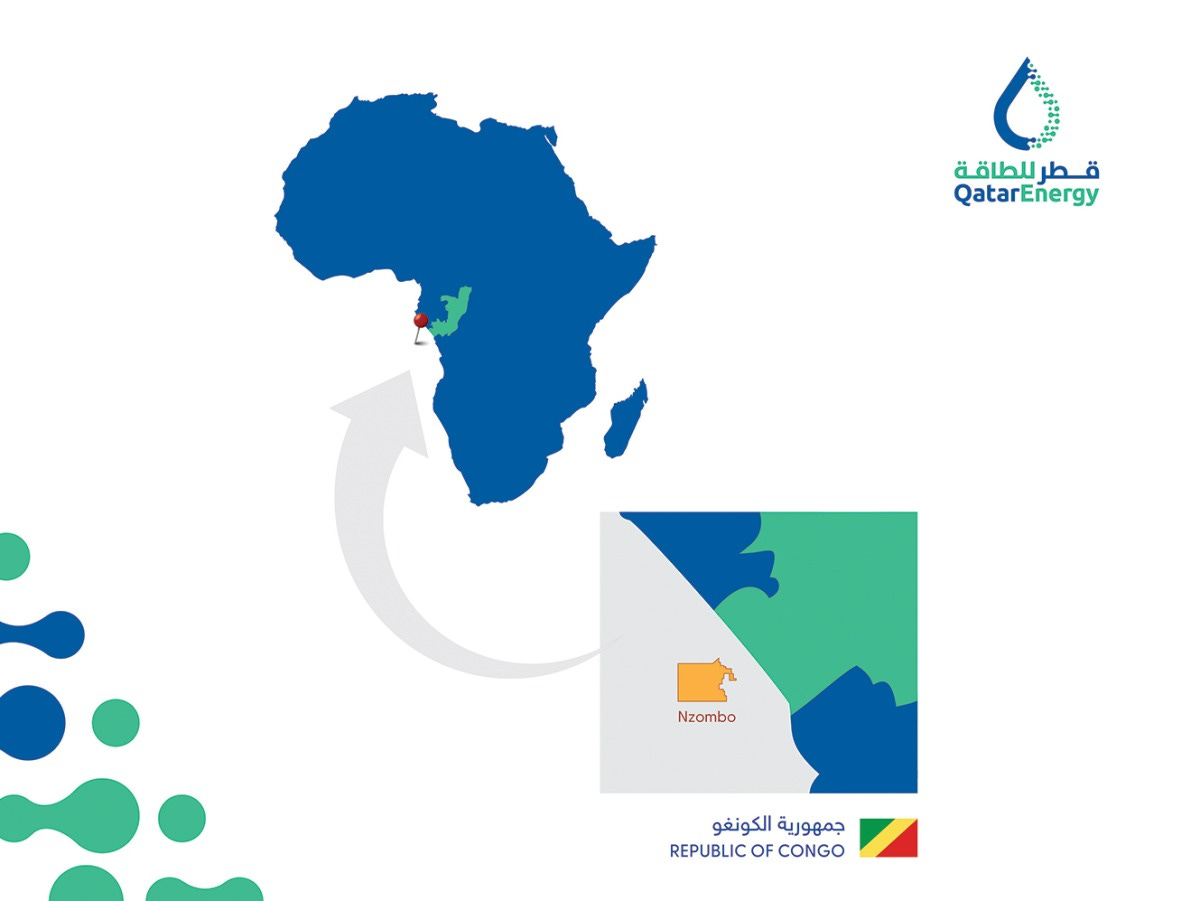

QatarEnergy Awarded Exploration Permit in Congo

Doha is mobilising public and private initiatives to expand its influence in Africa.

QatarEnergy, in partnership with TotalEnergies, has secured a deepwater Nzombo exploration permit off the coast of the Republic of Congo. This award aligns with a broader Gulf push into Africa, as Qatar seeks to diversify its economy and capitalise on the continent’s high-potential markets. QatarEnergy’s move dovetails with Al-Mansour Holdings’ $100 billion investment drive across Africa, underscoring a concerted Qatari effort, spanning both private and public sectors, to tap into the continent’s abundant natural resources.

Diversifying Beyond LNG

Qatar’s partnership with TotalEnergies to drill an exploration well reflects its strategic shift away from over-reliance on liquefied natural gas (LNG). With thermal electricity accounting for over 90% of its energy mix, Qatar’s National Renewable Energy Strategy (QNRES) signals a push towards solar and sustainable energy. However, the Congo venture, targeting 500,000 barrels per day by 2027, represents a pragmatic hedge—securing oil reserves to finance this transition while ensuring energy security amid global price volatility. This aligns with QatarEnergy’s expanding international portfolio, leveraging deepwater expertise to offset domestic limitations.

Politically, this move enhances Qatar’s mediation-led foreign policy, bolstering its leverage in energy geopolitics and countering criticism over its LNG dominance. Simultaneously, Al-Mansour Holdings’ $40 billion commitments in Mozambique and Zambia, part of a $100 billion African tour, underscore Qatar’s intensified economic outreach. These investments target minerals and natural gas vital for the clean energy transition, positioning Qatar against both regional and international rivals, namely Abu Dhabi and Beijing. Al-Mansour’s portrayal as a developmental partner, rather than a mere extractor, aims to secure long-term stakes in Africa’s supply chains, boosting local economies and financial markets.

The Congo permit, held by TotalEnergies (50%, operator), QatarEnergy (35%), and Société Nationale des Pétroles du Congo (15%), carries the resource curse risks—corruption and weak governance—historically associated with the Democratic Republic of Congo’s oil sector. This underscores Doha’s bold departure from its traditionally risk-averse investment approach. Nonetheless, proximity to existing Moho facilities provides potential cost efficiencies, which may help mitigate these challenges. For Congo, the development could enhance its status as a Central African energy hub.

Doha’s African initiatives are closely interconnected: Al-Mansour’s investments finance infrastructure to support resource extraction, while the Congo permit bolsters Qatar’s cash flow to sustain such ventures. Gulf competition is heightened as Qatar counters Emirati and Saudi inroads. This rivalry may enhance the bargaining power of African host nations, ultimately incentivising non-interventionist GCC states such as Qatar and Oman.